Blockchain Investigations: Tackling Cryptocurrency Scams and Frauds

- Understanding the Basics of Blockchain Technology

- Identifying Common Cryptocurrency Scams

- Tools and Techniques for Investigating Blockchain Transactions

- Case Studies of Successful Cryptocurrency Fraud Investigations

- Regulatory Challenges in Combating Cryptocurrency Scams

- The Future of Blockchain Investigations and Anti-Fraud Efforts

Understanding the Basics of Blockchain Technology

Blockchain technology is a revolutionary system that enables secure, transparent, and immutable record-keeping of transactions. At its core, a blockchain is a decentralized digital ledger that stores information across a network of computers, making it virtually impossible to alter or tamper with data once it has been recorded. This technology forms the foundation of cryptocurrencies like Bitcoin and Ethereum, which rely on blockchain to facilitate peer-to-peer transactions without the need for a central authority.

Blockchain operates on a distributed consensus mechanism, where network participants must agree on the validity of transactions before they are added to the ledger. This consensus is achieved through cryptographic algorithms that ensure the integrity and security of the data. Each block in the chain contains a unique cryptographic hash of the previous block, creating a chain of blocks that are linked together in a specific order.

One of the key features of blockchain is its transparency, as all transactions are visible to anyone on the network. This transparency helps to prevent fraud and ensures the integrity of the system. Additionally, blockchain technology allows for smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. Smart contracts automatically enforce the terms of the agreement without the need for intermediaries, reducing the risk of fraud and increasing efficiency.

In the context of cryptocurrency scams and frauds, blockchain technology plays a crucial role in enabling investigations and tracking down fraudulent activities. By analyzing the blockchain data, investigators can trace the flow of funds, identify suspicious transactions, and uncover the individuals behind fraudulent schemes. This level of transparency and traceability has made blockchain a valuable tool in combating financial crimes and protecting investors from scams in the cryptocurrency space.

Identifying Common Cryptocurrency Scams

When it comes to tackling cryptocurrency scams and frauds, it is essential to be able to identify common scams in the blockchain space. By being aware of the typical tactics used by scammers, investors can protect themselves from falling victim to fraudulent schemes.

One common cryptocurrency scam that investors should be wary of is phishing attacks. These scams involve sending out fake emails or messages that appear to be from legitimate cryptocurrency exchanges or wallet providers. The goal of these scams is to trick users into revealing their private keys or login credentials, which can then be used to steal their funds.

Another prevalent scam in the cryptocurrency world is Ponzi schemes. These schemes promise investors high returns on their investments, but in reality, they are using funds from new investors to pay returns to earlier investors. Eventually, the scheme collapses, leaving many investors with significant losses.

One more type of cryptocurrency scam to watch out for is fake ICOs (Initial Coin Offerings). These scams involve creating a fake website and whitepaper for a non-existent project, then encouraging investors to purchase tokens in the ICO. Once the funds are raised, the scammers disappear with the money, leaving investors with worthless tokens.

By familiarizing themselves with these common cryptocurrency scams, investors can better protect themselves from falling victim to fraud. It is crucial to always verify the legitimacy of any investment opportunity and never give out sensitive information to unknown parties. Remember, if an investment opportunity sounds too good to be true, it probably is.

Tools and Techniques for Investigating Blockchain Transactions

When it comes to investigating blockchain transactions, there are various tools and techniques that can be utilized to uncover fraudulent activities and scams within the cryptocurrency space.

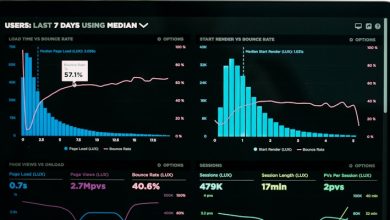

One essential tool for blockchain investigations is blockchain explorers. These online tools allow investigators to track and analyze transactions on the blockchain in real-time. By inputting wallet addresses or transaction IDs, investigators can gain valuable insights into the flow of funds and identify suspicious patterns.

Another technique used in blockchain investigations is transaction clustering. This process involves grouping together related addresses based on transactional patterns, which can help investigators identify the entities behind illicit activities.

Furthermore, forensic analysis tools can be employed to delve deeper into blockchain transactions. These tools use advanced algorithms to trace the origins and destinations of funds, uncovering hidden connections and exposing money laundering schemes.

In addition to these tools and techniques, collaboration with law enforcement agencies and blockchain experts is crucial in conducting thorough investigations. By leveraging the expertise of professionals in the field, investigators can maximize their efforts in combating cryptocurrency scams and frauds.

Case Studies of Successful Cryptocurrency Fraud Investigations

When it comes to investigating cryptocurrency fraud, case studies of successful investigations can provide valuable insights into how to tackle such scams effectively. Let’s take a look at some real-world examples of cryptocurrency fraud investigations that led to successful outcomes:

- A high-profile case involved a Ponzi scheme that promised investors high returns on their cryptocurrency investments. Through blockchain analysis and digital forensics, investigators were able to trace the flow of funds and identify the individuals behind the scam. This resulted in the arrest and prosecution of the fraudsters, as well as the recovery of stolen funds for the victims.

- In another case, a decentralized exchange was used as a platform for money laundering activities involving various cryptocurrencies. By analyzing transaction data on the blockchain, investigators were able to uncover the illicit activities and track down the individuals involved. This ultimately led to the shutdown of the exchange and the seizure of assets linked to the criminal operation.

- One more example is a phishing scam targeting users of a popular cryptocurrency wallet. By examining the phishing website and analyzing the blockchain transactions, investigators were able to identify the perpetrators and their methods. This enabled law enforcement agencies to take action against the scammers and prevent further fraudulent activities.

These case studies highlight the importance of blockchain investigations in combating cryptocurrency scams and frauds. By leveraging advanced technologies and forensic techniques, investigators can unravel complex schemes and bring perpetrators to justice. As the cryptocurrency ecosystem continues to evolve, staying ahead of fraudulent activities through effective investigation and enforcement will be crucial in maintaining trust and integrity in the industry.

Regulatory Challenges in Combating Cryptocurrency Scams

Addressing the regulatory challenges when it comes to combating cryptocurrency scams is crucial in the fight against fraudulent activities in the blockchain space. One of the main obstacles faced by regulators is the decentralized nature of cryptocurrencies, which makes it difficult to trace and monitor transactions. This lack of central authority means that scammers can operate with a certain level of anonymity, making it harder for authorities to identify and prosecute them.

Another issue is the cross-border nature of cryptocurrency scams, which can involve perpetrators and victims from different countries. This complicates the regulatory process as laws and regulations vary from one jurisdiction to another, making it challenging to coordinate efforts across borders. In addition, the fast-paced and constantly evolving nature of the cryptocurrency market means that regulators often struggle to keep up with the latest scams and fraud techniques.

Furthermore, the anonymity provided by cryptocurrencies can also be exploited by scammers to launder money and fund illegal activities. This poses a serious threat to the integrity of the financial system and requires regulators to implement stringent anti-money laundering (AML) and know your customer (KYC) measures to prevent such activities. However, enforcing these measures can be challenging given the pseudonymous nature of blockchain transactions.

The Future of Blockchain Investigations and Anti-Fraud Efforts

The future of blockchain investigations and anti-fraud efforts looks promising as technology continues to evolve. With the rise of advanced data analytics and artificial intelligence, investigators are better equipped to track and analyze suspicious transactions on the blockchain. These tools allow for more efficient detection of fraudulent activities, helping to protect investors and maintain the integrity of the cryptocurrency market.

Furthermore, collaborations between law enforcement agencies, regulatory bodies, and blockchain experts are becoming more common. By sharing information and resources, these stakeholders can work together to identify and dismantle cryptocurrency scams and fraud schemes. This coordinated approach is essential in combating the ever-evolving tactics used by fraudsters in the digital asset space.

As blockchain technology matures, we can expect to see improvements in security measures and protocol standards. These advancements will make it increasingly difficult for bad actors to exploit vulnerabilities in the system. Additionally, the growing emphasis on regulatory compliance within the cryptocurrency industry will help create a more transparent and trustworthy environment for investors.